Let's talk about something that gets everyone's attention—money, wealth, and the infamous "T net worth." If you're here, chances are you're curious about the financial empire of someone with the initial "T" or perhaps diving deep into what it takes to build a net worth that turns heads. Well, buckle up because we're diving straight into the world of numbers, assets, and everything in between.

Understanding net worth isn't just about knowing how much someone has in their bank account. It's about unraveling the story behind the numbers—the journey, the strategies, and the mindset that shapes financial success. Whether you're fascinated by a particular individual or just want to boost your own wealth-building game, this article's got you covered.

So, why focus on "T net worth"? Well, the "T" could stand for so many things—talent, tenacity, or even trillion dollars (hey, we can dream, right?). In this guide, we'll explore everything from the basics of net worth to the secrets of the rich and famous. Stick around, and let's crack the code to financial greatness!

Read also:Lisa Lopes The Legacy Of A Hiphop Icon

Before we dive deep, here's a quick roadmap to help you navigate through this treasure trove of information:

- What Is Net Worth?

- How to Calculate Net Worth

- Famous "T" Net Worth

- Building a Strong Net Worth

- Common Mistakes to Avoid

- Investment Strategies for Wealth Growth

- Financial Planning Tips for Long-Term Success

- Taxes and Net Worth

- Net Worth and Legacy

- Conclusion: Your Path to Financial Freedom

What Is Net Worth?

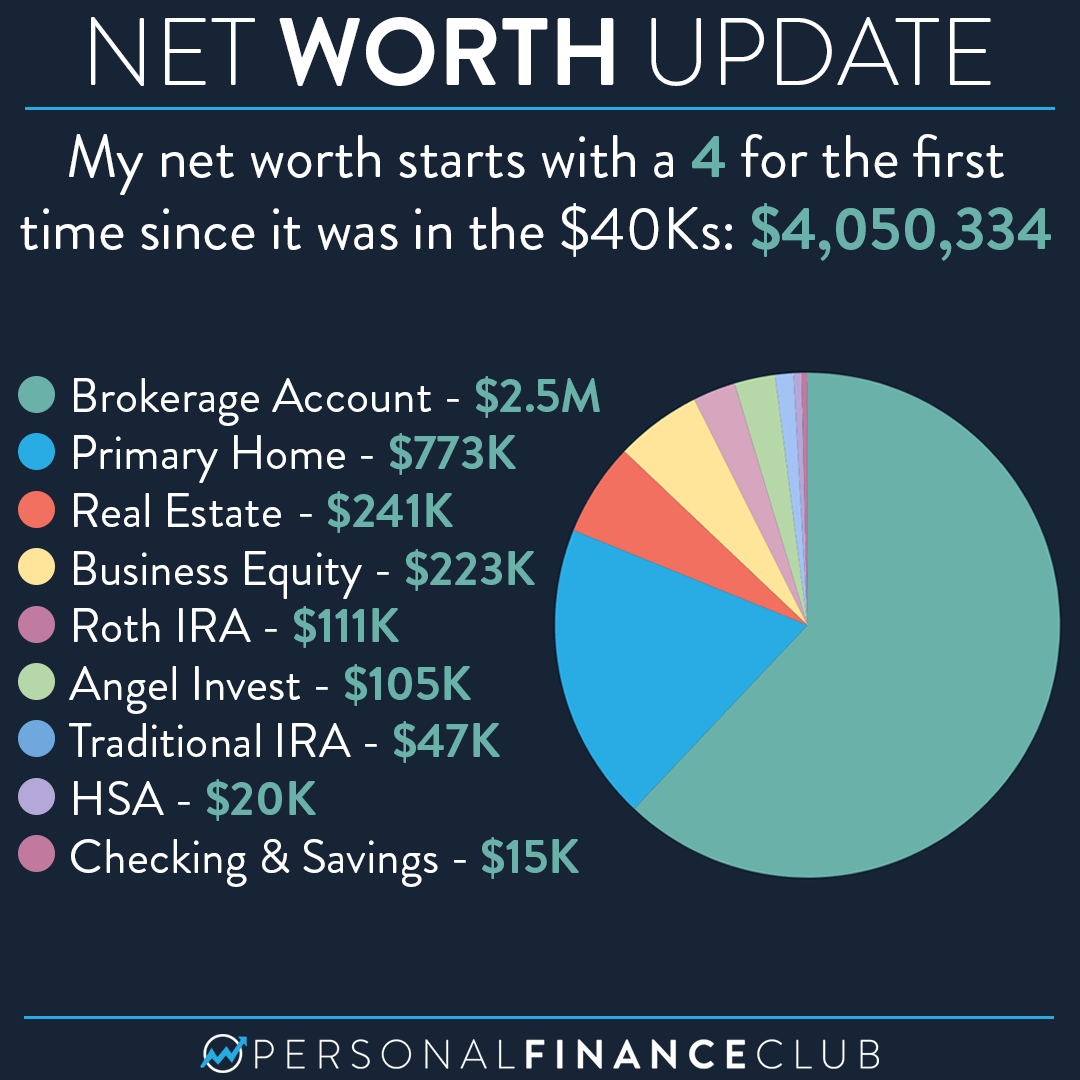

Alright, let's start with the basics. Net worth is essentially the difference between what you own (assets) and what you owe (liabilities). It's like taking a financial selfie—your overall financial health in one snapshot. For example, if you have a house worth $500k but still owe $200k on the mortgage, your net worth in this case would be $300k. Pretty straightforward, right?

But here's the kicker—net worth isn't just about the number. It's a reflection of your financial decisions, habits, and long-term vision. Whether you're building a business, investing in stocks, or just saving for retirement, understanding your net worth is crucial. It's the compass that guides your financial journey.

Why Knowing Your Net Worth Matters

Knowing your net worth gives you clarity. It helps you set realistic financial goals and track your progress. Imagine trying to navigate a maze without a map—it's chaotic and inefficient. Your net worth is that map, showing you where you've been and where you're headed.

Here are some key reasons why understanding your net worth is important:

- It helps you identify areas for improvement in your financial life.

- It allows you to make informed decisions about spending, saving, and investing.

- It provides a benchmark to measure your financial growth over time.

How to Calculate Net Worth

Calculating your net worth might sound intimidating, but it's actually pretty simple. All you need to do is add up your assets and subtract your liabilities. Let's break it down:

Read also:Bravenly Products Review Are They Worth Your Money

Assets: These are things you own that have value, like:

- Cash in bank accounts

- Real estate properties

- Investments (stocks, bonds, mutual funds)

- Retirement accounts (401k, IRA)

- Personal belongings (cars, jewelry, art)

Liabilities: These are debts or obligations you owe, such as:

- Mortgage

- Student loans

- Credit card debt

- Car loans

Once you've listed everything, subtract your total liabilities from your total assets. Voila! That's your net worth. Remember, it's okay if the number is negative at first. The key is to work towards improving it over time.

Famous "T" Net Worth

Now, let's talk about the big leagues. If you're wondering about the net worth of famous individuals with the initial "T," you're in the right place. From tech moguls to entertainment icons, here's a glimpse into their financial empires.

Tony Robbins

Tony Robbins is more than just a motivational speaker—he's a financial guru with a net worth estimated at $500 million. His secrets? Building a brand around personal development, authoring best-selling books, and delivering life-changing seminars. Robbins emphasizes the importance of mastering your mindset and taking massive action to achieve financial success.

Taylor Swift

Pop sensation Taylor Swift has amassed a net worth of over $600 million. Her success isn't just about hit songs—it's about building a loyal fan base, smart business decisions, and diversifying her income streams. Swift's empire includes music rights, endorsements, and merchandise, proving that creativity and business acumen go hand in hand.

Table: Key Data for Famous "T" Personalities

| Name | Profession | Net Worth | Notable Achievements |

|---|---|---|---|

| Tony Robbins | Motivational Speaker | $500 million | Best-selling author, influential speaker |

| Taylor Swift | Singer-Songwriter | $600 million | Multiple Grammy Awards, global music icon |

Building a Strong Net Worth

Building a strong net worth takes time, discipline, and a bit of strategy. Here are some actionable tips to help you grow your wealth:

1. Live Below Your Means

One of the simplest yet most powerful strategies is living below your means. It's not about depriving yourself—it's about prioritizing your financial future. By spending less than you earn, you create room for saving and investing.

2. Invest Early and Often

Time is your greatest ally when it comes to investing. The earlier you start, the more your money can grow through the power of compound interest. Whether it's stocks, real estate, or retirement accounts, investing consistently can significantly boost your net worth.

3. Diversify Your Income Streams

Don't put all your eggs in one basket. Diversifying your income streams can provide stability and growth. Consider side hustles, passive income opportunities, or starting a business to complement your primary income.

Common Mistakes to Avoid

Even the best-laid plans can go awry if you're not careful. Here are some common mistakes to avoid when building your net worth:

- Ignoring your credit score: A good credit score can save you thousands in interest over time.

- Not having an emergency fund: Life happens, and being financially prepared can save you from financial ruin.

- Overspending on depreciating assets: Cars, gadgets, and other items lose value over time. Focus on investing in appreciating assets instead.

Investment Strategies for Wealth Growth

Investing is a key component of building wealth. Here are some strategies to consider:

1. Index Funds

Index funds are a great way to diversify your portfolio without the hassle of picking individual stocks. They offer low fees and historically strong returns, making them a solid choice for long-term investors.

2. Real Estate

Real estate can be a lucrative investment, especially if you're willing to put in the work. Whether it's buying rental properties or flipping houses, real estate offers both income and appreciation potential.

Financial Planning Tips for Long-Term Success

Financial planning is the backbone of long-term success. Here are some tips to keep you on track:

- Set clear financial goals and create a roadmap to achieve them.

- Review your financial plan regularly and make adjustments as needed.

- Seek professional advice if you're unsure about certain aspects of your financial plan.

Taxes and Net Worth

Taxes can significantly impact your net worth, so it's crucial to understand how they work. From tax-efficient investments to retirement accounts, there are strategies to minimize your tax burden and maximize your wealth.

Net Worth and Legacy

Your net worth isn't just about the numbers—it's about the legacy you leave behind. Whether it's through charitable contributions, family inheritance, or impactful businesses, your financial success can shape the world around you.

Conclusion: Your Path to Financial Freedom

Understanding and building your net worth is a journey, not a destination. It requires patience, persistence, and a willingness to learn. By following the strategies outlined in this guide, you can take control of your financial future and achieve the success you deserve.

So, what's next? Take action! Start by calculating your net worth, setting financial goals, and implementing the strategies we've discussed. And don't forget to share this article with your friends and family—it's always better to grow together!