Have you ever wondered how much someone's net worth truly means? In today's world, the term "T net worth" has become more than just a number—it's a reflection of success, influence, and power. Whether you're curious about celebrities, entrepreneurs, or even your own financial standing, understanding net worth is essential. Let's dive into what it really means, why it matters, and how you can calculate yours like a pro!

So, what exactly is T net worth? It's not just about the money in your bank account. It's the total value of everything you own minus any debts or liabilities. Think of it as the financial snapshot of your life. This concept applies to everyone, from the average Joe to the richest individuals on the planet. It's all about assets versus liabilities, and that's where the magic happens.

In this article, we're going to break it down step by step. You'll learn how to calculate net worth, explore the factors that influence it, and even discover how some of the most successful people manage to grow theirs. Whether you're here for personal knowledge or want to understand the financial landscape better, this guide is for you. Let's get started, shall we?

Read also:Sona Heiden Unveiling The Life Achievements And Impact Of A Remarkable Figure

What is T Net Worth?

Let's start with the basics. T net worth, or simply net worth, is the difference between what you own (assets) and what you owe (liabilities). It's like a financial scorecard that shows where you stand financially at any given time. For example, if you own a house worth $500,000 but still owe $200,000 on the mortgage, your net worth from that asset alone would be $300,000. Pretty straightforward, right?

Here's the thing, though: net worth isn't just about numbers. It's a measure of financial health and stability. A positive net worth indicates that you have more assets than liabilities, which is generally a good thing. On the flip side, a negative net worth means you owe more than you own, and that's when you might want to rethink your financial strategy.

How to Calculate T Net Worth

Calculating your T net worth is simpler than you might think. All you need to do is add up all your assets and subtract all your liabilities. Here's a quick breakdown:

- Assets: These are things you own that have value, like your home, car, savings, investments, and even valuable collectibles.

- Liabilities: These are your debts or financial obligations, such as mortgages, car loans, credit card balances, and student loans.

So, if your assets total $700,000 and your liabilities add up to $300,000, your net worth would be $400,000. Easy peasy!

Why Does T Net Worth Matter?

Knowing your T net worth is crucial for several reasons. First and foremost, it gives you a clear picture of your financial situation. It helps you make informed decisions about saving, investing, and spending. Plus, it's a great motivator for improving your financial health.

For businesses and investors, net worth is a key indicator of financial stability. It can affect your credit score, borrowing power, and even your ability to secure loans. In short, it's not just about personal finance—it's about building a solid financial foundation for the future.

Read also:Oracene Price A Deep Dive Into The World Of This Revolutionary Blockchain Token

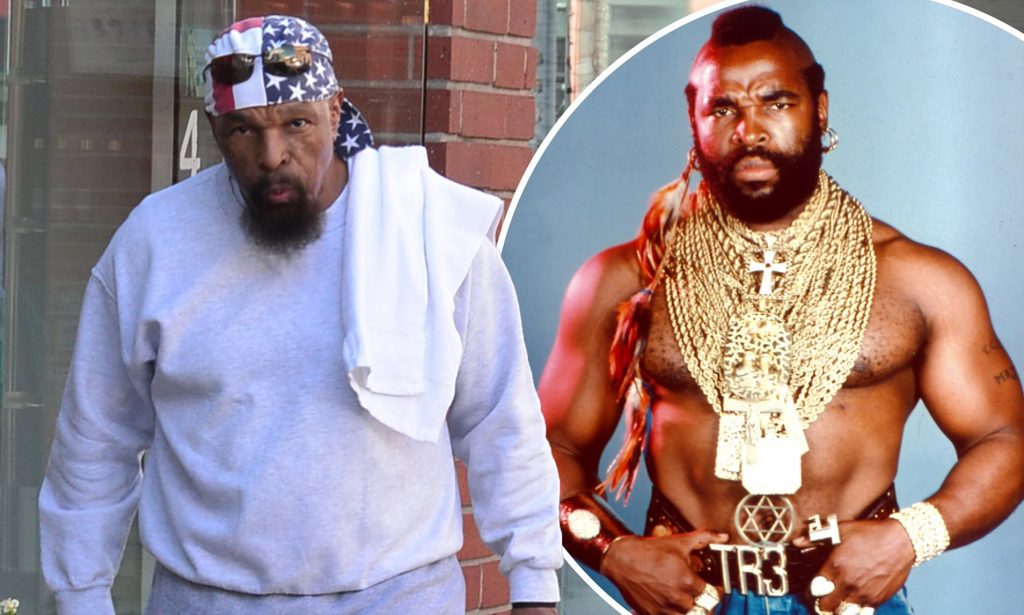

Famous T Net Worth Examples

Let's take a look at some famous individuals and their T net worth. These examples will give you a better idea of how net worth works in the real world.

Biography of Elon Musk

Elon Musk, the CEO of Tesla and SpaceX, is one of the richest people on the planet. His journey from a young entrepreneur to a billionaire is nothing short of inspiring.

| Full Name | Elon Reeve Musk |

|---|---|

| Date of Birth | June 28, 1971 |

| Net Worth | $250 billion (as of 2023) |

| Occupation | Entrepreneur, CEO |

Elon's net worth is largely tied to his shares in Tesla and SpaceX. His ability to innovate and disrupt industries has played a huge role in his financial success.

Factors That Influence T Net Worth

Your T net worth can be influenced by a variety of factors. Here are some of the most common ones:

- Income: The more you earn, the more opportunities you have to build wealth.

- Expenses: Keeping your expenses in check is key to increasing your net worth.

- Investments: Smart investments can significantly boost your net worth over time.

- Debts: High levels of debt can drag down your net worth, so it's important to manage them wisely.

By understanding these factors, you can take proactive steps to improve your financial situation.

Strategies to Increase T Net Worth

Now that you know what affects your T net worth, let's talk about how to increase it. Here are some strategies to consider:

1. Save More

Saving is the foundation of building wealth. The more you save, the more you can invest in assets that appreciate in value over time.

2. Invest Wisely

Investing in stocks, real estate, or other assets can help grow your net worth. Just make sure you do your research and diversify your portfolio.

3. Pay Down Debt

Reducing your debt is one of the fastest ways to improve your net worth. Focus on paying off high-interest debt first, like credit card balances.

4. Boost Your Income

Increasing your income through promotions, side hustles, or starting a business can accelerate your wealth-building journey.

T Net Worth Trends

In recent years, there has been a noticeable shift in how people view and manage their T net worth. More individuals are focusing on long-term wealth building rather than short-term gains. This trend is driven by factors like:

- Economic Uncertainty: With global markets constantly changing, people are becoming more cautious with their finances.

- Technological Advancements: The rise of fintech apps and online investing platforms has made it easier for people to track and grow their net worth.

- Social Awareness: There's a growing emphasis on financial literacy and education, helping people make smarter financial decisions.

These trends highlight the importance of staying informed and adaptable in today's financial landscape.

Common Misconceptions About T Net Worth

There are several myths and misconceptions surrounding T net worth. Let's debunk a few of them:

1. Net Worth Equals Happiness

While having a high net worth can provide financial security, it doesn't guarantee happiness. True fulfillment comes from a balanced life, not just financial success.

2. Only the Rich Have Net Worth

Everyone has a net worth, whether it's positive or negative. It's not exclusive to the wealthy—it's a universal financial concept.

3. More Income Equals Higher Net Worth

Not necessarily. If you spend more than you earn, your net worth could still be negative, regardless of your income level.

Tools to Track T Net Worth

There are plenty of tools and apps available to help you track and manage your T net worth. Some of the most popular ones include:

- Mint: A comprehensive budgeting and finance-tracking app.

- Personal Capital: Offers tools for tracking net worth, investments, and retirement planning.

- You Need A Budget (YNAB): Focuses on budgeting and financial goal-setting.

These tools can simplify the process of calculating and monitoring your net worth, making it easier to stay on top of your finances.

Conclusion

Understanding T net worth is an essential part of managing your finances and building wealth. By calculating your net worth regularly, identifying factors that influence it, and implementing strategies to increase it, you can take control of your financial future.

So, what are you waiting for? Start tracking your net worth today and take the first step toward financial independence. And don't forget to share this article with your friends and family—knowledge is power, after all!

Table of Contents

- T Net Worth: The Ultimate Guide to Understanding Wealth in Today's World

- What is T Net Worth?

- How to Calculate T Net Worth

- Why Does T Net Worth Matter?

- Famous T Net Worth Examples

- Biography of Elon Musk

- Factors That Influence T Net Worth

- Strategies to Increase T Net Worth

- Save More

- Invest Wisely

- Pay Down Debt

- Boost Your Income

- T Net Worth Trends

- Common Misconceptions About T Net Worth

- Tools to Track T Net Worth

- Conclusion